-

Appraisal of Manufactured Homes Course

Who Should Enroll: Residential appraisers and reviewers who are currently working in the secondary market lending space: appraisals for loans that are ultimately purchased by Freddie Mac, FHA, VA, USDA, or Fannie Mae. This Appraisal Institute course, developed in collaboration with Freddie Mac, provides an in-depth look into preparing appraisals for traditional manufactured homes plus insight into CHOICEHomeSM—the new type of high-quality manufactured homes that are built to HUD code but developed with site-built features. You’ll learn how to meet the specific requirements of Freddie Mac, the FHA, VA, USDA and Fannie Mae using a new, ground-breaking tool—the Manufactured Home Quality Rating Worksheet – which is consistent with the Marshall & Swift®—CoreLogic Residential Cost Handbook and the Uniform Appraisal Dataset (UAD).View Course -

Pew Issue Brief | FHA Loan Programs Aren’t Reaching Black Manufactured Home Buyers

Americans have difficulty getting loans to buy manufactured homes: Denial rates for these loans are more than seven times higher than for those used to purchase comparable site-built (non-manufactured) homes. However, financing challenges are not the same for all buyers. Research shows that lenders deny manufactured home loans to Black applicants at significantly higher rates than they deny loans to White applicants, effectively keeping many Black buyers from one of the nation’s most affordable pathways to homeownership. This Pew Issue Brief explores this trend and recommends that policymakers looking to expand homeownership opportunities for Black households consider ways to increase the number of Black manufactured home buyers who apply for FHA mortgages—and decrease the number who apply for conventional loans. They recommend the FHA actively encourage major lenders to offer more federally insured loans and expand its outreach efforts in the Southeastern United States, where most Black manufactured home buyers live—and where few manufactured home lenders offer FHA financing.Read More -

Things to Know About Energy-Efficient Manufactured Homes

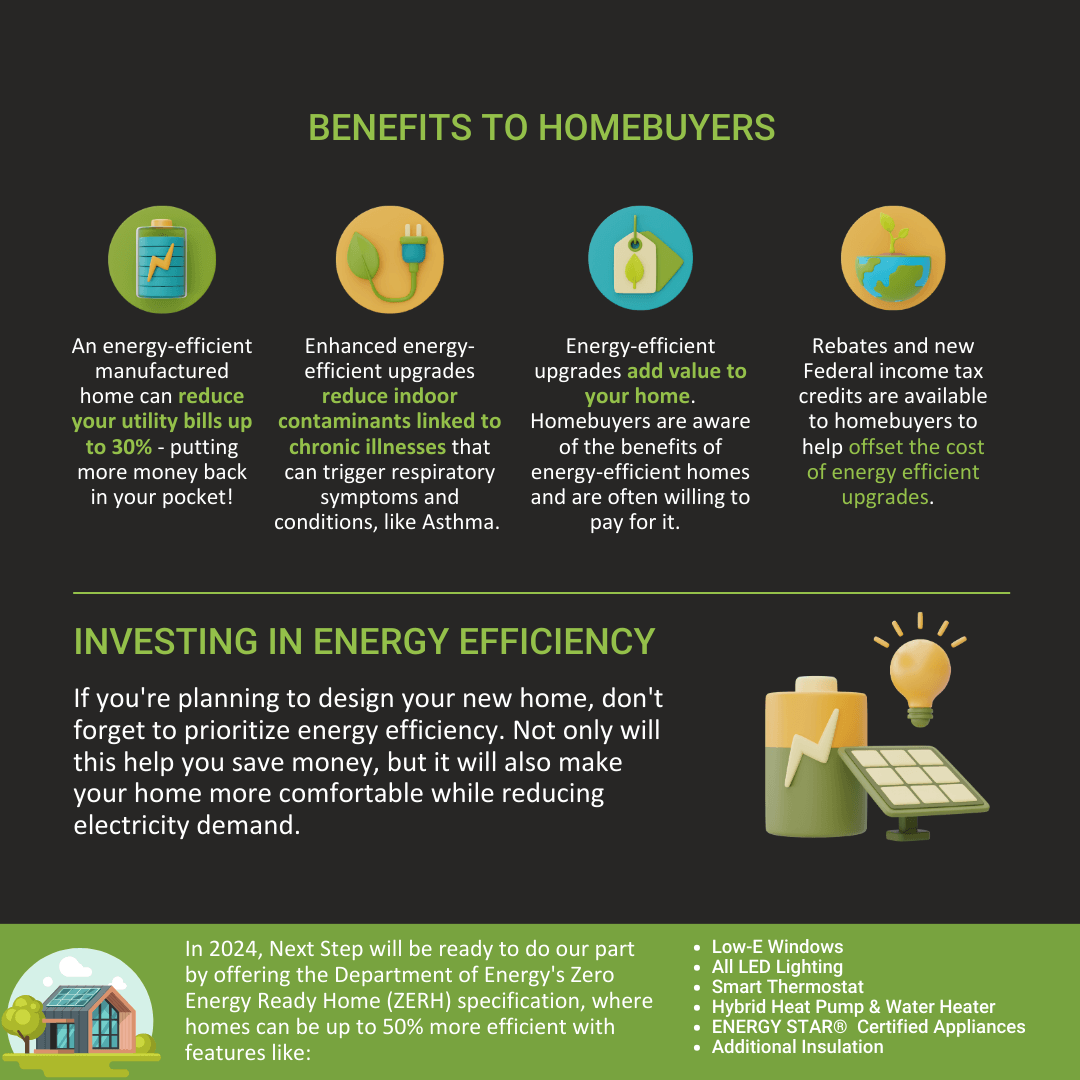

When it comes to housing options, manufactured homes have come a long way in recent years. Once stereotyped as less efficient and less environmentally friendly than site-built houses, manufactured housing has undergone significant advancements that not only enhance their quality and energy efficiency but also contribute positively to the environment. In this post, we'll explore some energy-efficient aspects of manufactured housing and why it should be considered a sustainable and cost-effective home solution.

Increased Energy Efficiency Equals Increased Value

One of the most significant selling points of manufactured homes – and increasingly, all homes - is their potential for increased energy efficiency. Upgrading to a more energy-efficient home package can be a powerful investment, not only in terms of reducing your monthly utility bills but also increasing the overall value of your home. If you're considering purchasing a manufactured home, consult with a home sales representative about the options for improving energy efficiency. They can guide you on the various upgrades, including insulation, windows, and appliances, that can make your home more energy efficient. Moreover, inquire about rebates that might be available for upgrading to an ENERGY STAR®-rated home. Many utility companies and power cooperatives offer rebates to incentivize homebuyers to choose more energy-efficient housing options.Factory-Built ENERGY STAR-Certified Homes Save Money

Energy efficiency isn't just about being environmentally responsible; it can also save you a significant amount of money. Factory-built ENERGY STAR-certified homes are designed to consume less energy, resulting in substantial savings on your monthly utility bills. In fact, these homes can save you up to 30% on your energy costs compared to traditional homes. By reducing your carbon footprint and cutting down on utility expenses, you positively impact your wallet and contribute to a greener and more sustainable future.Reduced Waste, Less Environmental Impact

Manufactured homes have another eco-friendly advantage that many might not be aware of - the construction process generates significantly less waste than site-built housing. Traditional construction can result in enormous amounts of waste, with materials discarded in landfills, which has profound environmental implications. Landfills produce methane gas, a potent greenhouse gas 84 times more potent than carbon dioxide. By choosing a manufactured home, you are making a sustainable choice for your family and supporting environmentally responsible construction practices that help protect our planet.Manufactured Homes and Solar Panels: A Perfect Match

One of the most exciting developments in the world of manufactured housing is the compatibility with solar panels. In 2019, a partnership between Next Step, the City of San Bernardino, and the local nonprofit organization Neighborhood Partnership Housing Services, Inc. (NPHS) demonstrated the potential of ENERGY STAR®-rated manufactured homes outfitted with solar panels. The goal was to create net-zero energy homes, meaning these homes generate as much energy as they consume, often producing surplus energy that can be sold back to the grid. This not only results in reduced energy costs for homeowners but also a significant reduction in the carbon footprint of these households. These homes are a shining example of how manufactured housing can be at the forefront of sustainable and environmentally friendly living, showcasing the potential for solar power integration that can be a game-changer for energy conservation and cost savings. In conclusion, manufactured housing is different from what it used to be. These homes have evolved into energy-efficient, cost-effective, and eco-friendly alternatives to site-built. By investing in an ENERGY STAR®-rated manufactured home, you can enjoy substantial savings on your utility bills, reduce your environmental impact, and potentially even become a net-zero energy household with the addition of solar panels. So, if you're considering a new home, make sure to explore the possibilities of manufactured housing and take advantage of the energy-efficient and eco-friendly options available. Learn more about manufactured homes here or visit our Resource Library. -

MH101: Introduction to Manufactured Housing for Homebuyers [FREE Course]

Manufactured homes have evolved into stunning, affordable homes that are nearly indistinguishable from traditional site-built houses. They are an excellent option for those seeking a durable home that can build wealth over time.Why Choose Manufactured Housing?

- Affordable & Beautiful: Modern manufactured homes are designed with aesthetics and affordability in mind.

- Wealth Building: These homes are a smart investment, often appreciating in value.

- Durability: Built to withstand various elements, manufactured homes are long-lasting.

Learn More with Our Introduction to Manufactured Housing (MH101) Course

Our Introduction to Manufactured Housing course provides a comprehensive overview of what manufactured homes are and aren't. In this course, you will learn:- Key Concepts & Terminology: Understand the terms used in today's manufactured housing market.

- Facts and Myths: Discover how manufactured homes appreciate in value and withstand environmental factors.

- Financing Options: Explore various financing methods to make your homeownership dream a reality.

- Duration: Approximately 30 minutes

- Outcome: Gain a clear understanding of why manufactured housing is a smart, affordable choice for many homebuyers.

Get Started Today

To start the course, create an account on our learning management system at learnnextstep.org.VIEW COURSE -

10 Things Manufactured Housing Developers Should Know

This guide delves into key insights that developers need to understand when considering manufactured housing as a viable solution for creating affordable housing options. This document provides an invaluable guide to navigating the intricacies of integrating manufactured housing into development projects. Covering a range of topics, from design and regulations to community integration and financial viability, this comprehensive resource equips developers with the knowledge necessary to harness the potential of manufactured housing and make a positive impact on communities while addressing housing affordability challenges. By exploring these ten crucial factors, developers can make informed decisions that lead to successful and socially responsible housing developments.DOWNLOAD RESOURCE -

Manufactured Housing Glossary for Developers

Whether you're just learning about manufactured housing or looking to expand your technical vocabulary, this glossary provides clear definitions for the most common terms in the field. Our aim is to simplify the technical language, acquaint you with important industry stakeholders, and clarify the different parts and elements of a manufactured home. Box: Commonly referred to as a home section, i.e., one half of a multi-section home or the single-section unit itself. Box Width: Commonly referred to as the floor width or the perimeter floor dimensions of a single section or one-half of a multi-section unit. CrossMod™: A manufactured home industry term that defines home features that Fannie Mae and Freddie Mac look for when providing conventional financing for manufactured homes with MHAdvantage and CHOICEHome®, respectively. It is a manufactured home built to the HUD Code and not a modular home. Crossovers: Utility interconnections between sections of multi-section homes, including heating and cooling ducts, electrical circuits, water pipes, drain plumbing and gas lines. Endwall: The walls on the end of the unit that represent the width of the unit. ENERGY STAR® Certification Label: The ENERGY STAR label certifies that the home meets the requirements for ENERGY STAR and can be found typically with the data plate. Factory-Built Home: A home built in a factory and shipped to a retailer or the site. It includes both manufactured and modular homes. Frame: The frame is the steel chassis on which a manufactured home is constructed. Manufactured homes cannot have the frame removed.- H-Beam: Steel beams, also called crossbeams, are often used to support the home over a basement or crawlspace. They span the foundation from sidewall to sidewall, typically with an intermediate support pier and footing (typically in the center point, resulting in a line of piers under the centerline of a double-section home).

- I-Beams: Long steel beams that are part of the chassis that run the length of the home.

- CHOICEHome® (Freddie Mac)

- MHAdvantage (Fannie Mae)

DOWNLOAD RESOURCE -

Manufactured Housing Glossary for Homebuyers

No matter the type of home you're purchasing, educating yourself on the homebuying process is a crucial first step. As you dive into this research, you might encounter brand new terms that are key to your success as a new homebuyer. If you're considering factory-built as a home option, then there are even more terms that you should know. No worries, though – this glossary of terms defines common housing terms and introduces manufactured housing definitions that will help you better navigate your homeownership journey.Manufactured Housing Terms

Chassis The structural frame of a manufactured home that supports the complete unit of walls, floor, and roof. Chattel Loan A personal property loan, somewhat like a car loan, made for the purchase of a manufactured home that is not permanently affixed to real estate. These loans are the most common and most utilized for financing manufactured homes. CHOICEHome Mortgages Freddie Mac's affordable mortgage initiative offers conventional site-built financing for real-property factory-built homes built to the HUD code but with many features of a site-built home. Offers financing with as little as 3% down and lower financing costs. CrossMod The industry-wide term that captures and expands on many of the new home features that Fannie Mae and Freddie Mac look for when providing conventional financing for manufactured homes with MH Advantage and CHOICEHome, respectively. Data Plate An information sheet located on a cabinet door under the kitchen sink or a wall or door face near the electrical panel, utility room or primary bedroom closet. It contains a unique identification number and identifies the wind zone, roof load zone and climatic zone for which the home was constructed. Manufactured Housing A Single-family residential dwelling, built to a national construction standard (HUD Code) and comes in both, a single or multi-section. MHAdvantage Mortgages An affordable financing option offered by Fannie Mae to support mortgage lending for manufactured homes. This product combines features, like a down payment as low as 3%, with the lower price and customizable finishes of modern manufactured homes. The appraiser will include photos of the MH Advantage manufacturer sticker. Modular Another type of prefabricated home that is constructed in a factory and then assembled at the building site and built to the local or state building code. Permanent Foundation A foundation constructed of durable materials such as concrete, mortar masonry, or treated wood. It must have attachment points to anchor and stabilize the manufactured home to transfer all loads to underlying soil or rock. Resident-Owned Community (ROC) A resident-owned community is a neighborhood of manufactured homes owned by a cooperative of homeowners who live there as opposed to an outside landlord. Retailer A retailer is a seller of homes manufactured within a factory. Retailers of factory-built housing must follow explicit guidelines outlined by federal and state agencies.General Housing Terms

Appreciation The increase in value of a home over a period of time. Appraiser A person whose job is to assess the monetary value of something, like a home. Closing Closing is the final phase of mortgage loan processing in which the property title passes from the seller to the buyer. Down Payment An initial payment made when something is bought on credit, such as a home. The payment represents a percentage of the total purchase price, usually 5 to 20 percent of the home price. Down payments decrease the interest paid over the loan's lifetime, lower the monthly payments, and provide the lender with a "security" payment that the buyer is good for the remainder of the loan. Down Payment Assistance Funding from a third party not associated with the transaction that's intended to help with the down payment and closing costs on a home purchase. ENERGY STAR® A program that provides certification to buildings and consumer products that meet specific energy efficiency standards. First-Time Homebuyer A borrower who did not have ownership interest (joint or sole) in a residential property during the three years preceding the date of the new purchase. Freddie Mac Freddie Mac is an alternative name for the Federal Home Loan Mortgage Corporation or FHLMC. It’s a government-sponsored enterprise (GSE) created in 1970 as part of the Emergency Home Finance Act to expand the secondary mortgage market in the United States. Fannie Mae Fannie Mae is a government-sponsored enterprise (GSE) that purchases mortgage loans from smaller banks or credit unions and guarantees, or backs, these loans on the mortgage market for low-to-median income borrowers. Government-Sponsored Enterprise (GSE) A quasi-governmental, privately held agency established by Congress to improve credit flow in some regions of the United States' economy. They provide financial services to the public for various things, particularly mortgages, through capital market liquidity. Housing Finance Agency (HFA) State-chartered nonprofit organizations that provide financing and services for affordable housing and related community development activities. Housing Counselor A financial advocate specifically trained to advise and counsel homebuyers and homeowners. Inspection A visual assessment of a home's condition in which inspectors look for thousands of potential problems in areas of the house, including ceilings, walls, floors, windows, and doors. Mortgage A loan given by a bank, mortgage company or other financial institution for the purchase of a residence. Because a mortgage is secured debt—the home acts as backing for the loan—mortgages come with lower interest rates than most other types of loans. Mortgage Lender A financial institution or mortgage bank that offers and underwrites home loans. Mortgage Insurance An insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage. Title A document that shows legal ownership of a property or asset. Tax Credits A dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund. We know the homebuying process can seem intimidating, especially when considering all the new terminology you need to learn to understand each step to homeownership. This tool can help you familiarize yourself with some common terms you'll encounter, but a great housing counselor can also be beneficial. Find a HUD-certified housing counselor here or visit our Resource Library for additional homebuyer tools and guides.DOWNLOAD RESOURCE -

Manufactured Housing Education Slides

Next Step created these two slides that can be added to any HUD counseling and education program. They meet the HUD requirement to cover the full scope of homeownership, including a discussion of alternatives (HUD Handbook 7610.1 revision 5) "Counselors must not advise clients or promote specific products, features or programs. Their role is to simply make counseling recipients aware of their options and empower them with the information they need to help them make smart choices."DOWNLOAD HERE -

Filling the Gap: Leveraging Manufactured Homes for New Development

The lack of current attainable, sustainable housing has made it nearly impossible for many people to realize the American dream of homeownership. Research shows a housing supply gap of 3.8 million housing units, and construction of entry-level homes is at a 50-year low. Manufactured homes offer forward-thinking designs, energy-efficient features, and high-end materials without sacrificing the efficiency, quality, and construction speed that comes with off-site home construction. It’s an innovative and cost-saving solution for both developers and homebuyers. On June 21, 2023, Next Step and Clayton spoke with researchers, local officials, and housing practitioners about opportunities for infill housing and new home subdivision development. -

Top Ten Factory-Built Facts

Buying a home is one of the most important decisions you'll ever make, so it's essential to know about the different home options available. One of the quickest and most affordable options is a factory-built home - a modern, customizable home that can make homeownership more attainable. These Top Ten Factory-Built Facts will address any misconceptions you may have and show that factory-built housing can be the perfect choice for your housing needs.DOWNLOAD IN ENGLISH DOWNLOAD IN SPANISH