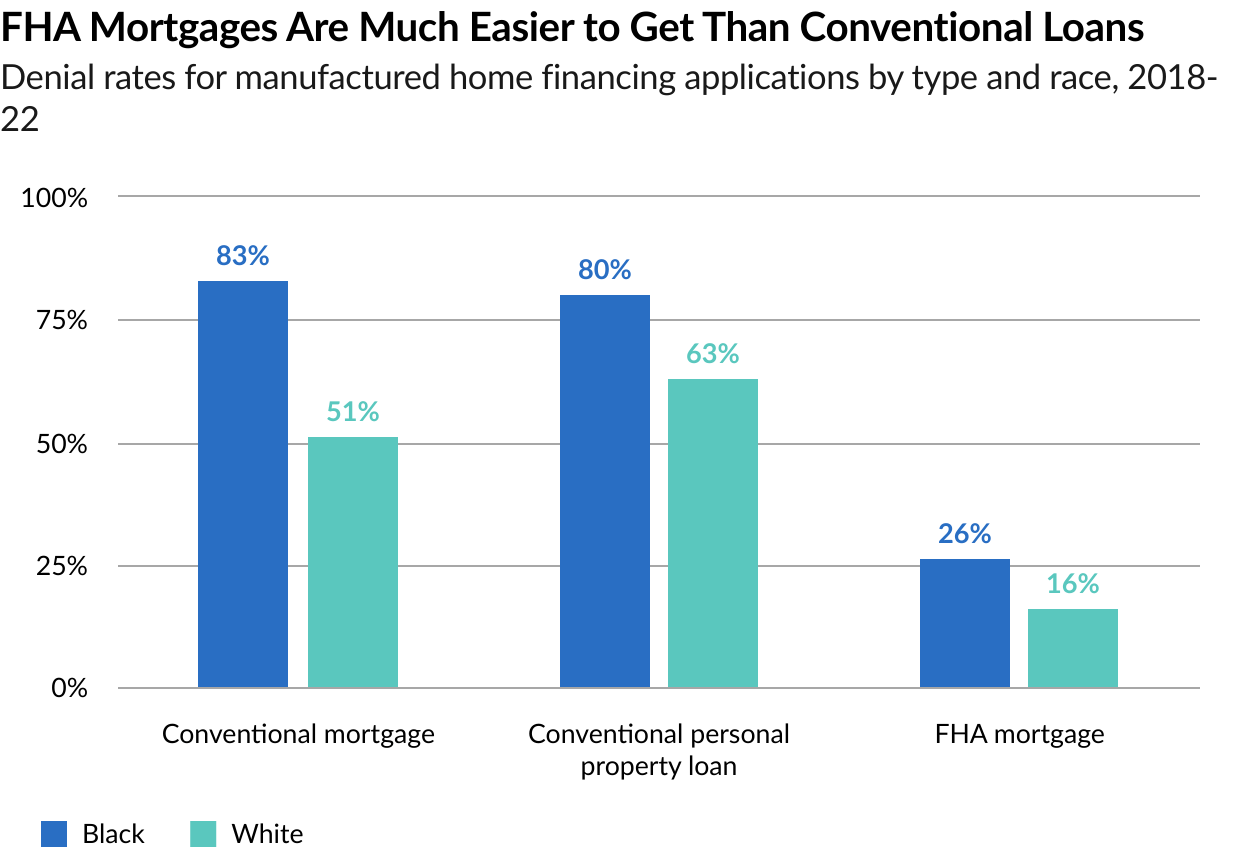

Americans have difficulty getting loans to buy manufactured homes: Denial rates for these loans are more than seven times higher than for those used to purchase comparable site-built (non-manufactured) homes. However, financing challenges are not the same for all buyers. Research shows that lenders deny manufactured home loans to Black applicants at significantly higher rates than they deny loans to White applicants, effectively keeping many Black buyers from one of the nation’s most affordable pathways to homeownership.

This Pew Issue Brief explores this trend and recommends that policymakers looking to expand homeownership opportunities for Black households consider ways to increase the number of Black manufactured home buyers who apply for FHA mortgages—and decrease the number who apply for conventional loans. They recommend the FHA actively encourage major lenders to offer more federally insured loans and expand its outreach efforts in the Southeastern United States, where most Black manufactured home buyers live—and where few manufactured home lenders offer FHA financing.

|